NOTE: The Honda CR-V in the infographic is still the previous generation, hence the lower price than the new base model CR-V.

When the Department of Finance first released its early proposals for comprehensive tax reforms earlier this year, many in the automotive industry were fearful the proposed excise taxes on motor vehicles may dampen demand for automobiles, especially luxury cars. The DOF proposals, which were largely adopted by the House of Representatives, imposed progressively heavier taxes on pricier cars compared to the cheaper models.

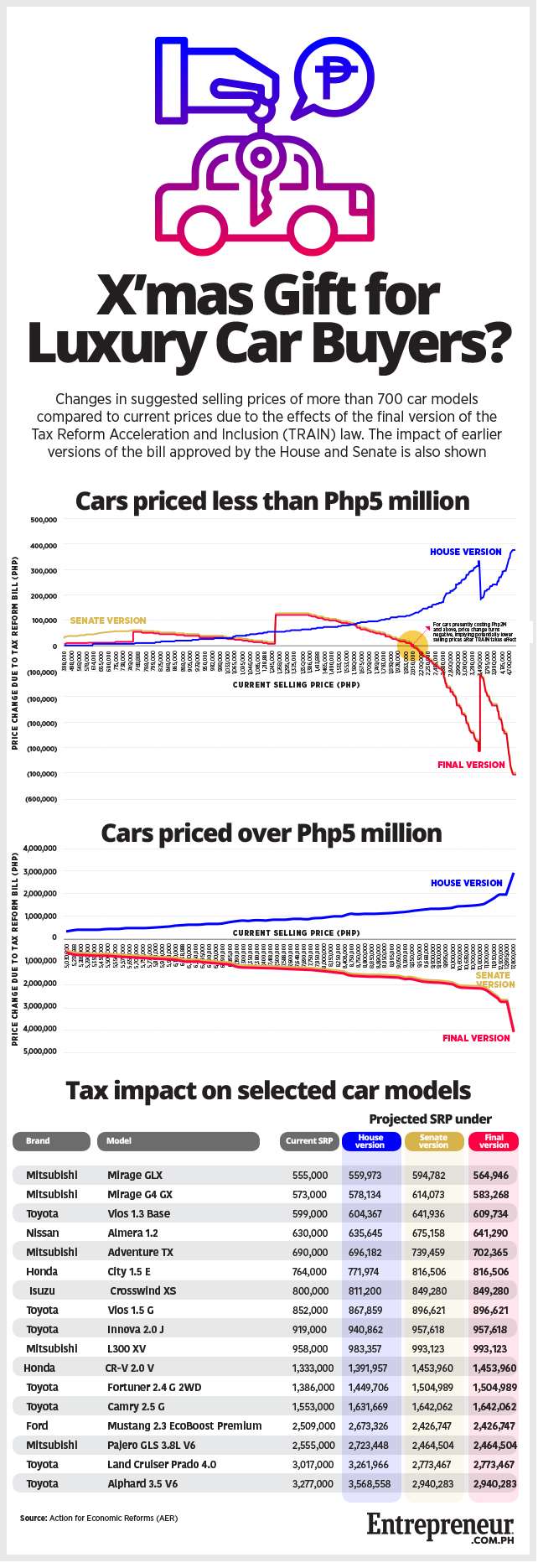

As it turned out, the industry’s fears were unfounded. The final version of the Tax Reform for Acceleration and Inclusion (TRAIN) law approved by the Senate and the House on December 13 isn’t as harsh as initially thought on the most expensive car models. It will still lead to higher prices, though, of both the low-priced and mid-priced car models.

Indeed, analysis by the Action on Economic Reforms (AER), an economic policy and advocacy group that supported the DOF’s tax reform proposals, shows that cars currently costing P2 million or more will probably see a possible cut in prices when the TRAIN law takes into effect (see infographic). President Rodrigo Duterte is expected to sign the tax measure by December 19, allowing it to take effect by early January 2018.

For example, while the best-selling Toyota Vios 1.3, which currently sells for around P599,000, will see a P10,734 increase because of the tax measure, the Ford Mustang 2.3 EcoBoost Premium, which presently costs P2.5 million, will possibly see a cut of P82,253. Meanwhile, a medium-priced vehicle such as the Isuzu Crosswind XS, currently selling for P800,000, will be likely be subjected to a P49,280 price rise—although we know that model's days are numbered.

“The final TRAIN version will effectively lower the prices of vehicles classified in the highest tier of models, in comparison to the current rates. This is because the marginal tax rates for the highest tier, which is 60% in the NIRC (National Internal Revenue Code), will be lowered to just 50 percent under TRAIN,” said Adolfo Jose Montessa, an analyst at the AER. “This is a significantly lower rate than what was originally proposed by the Department of Finance—120% and even than the original Senate Committee report before amendments were heard during the plenary—100%.”

Under the current tax regime, the most expensive cars (or those with a net manufacturer or importer’s price of P2.1 million and above) are subject to a tax of P512,000 plus 60% of the value in excess of P2.1 million. Under TRAIN, the costliest units (over P4 million) are taxed at only 50%.

The resulting tax structure leads to a rather odd result, according to AER. “The automobile excise taxes in the final version of TRAIN effectively provides a discount for luxury cars, while ironically raising the effective tax rates on lower end cars,” says Montessa.

Pauline Macaraeg is Entrepreneur PH's data journalist. Follow her on Twitter @paulinemacaraeg

NOTE: This story first appeared on Entrepreneur.com.ph. Minor edits have been made.