If you travel by air frequently, you’ve probably noticed how expensive it can be to fly to local and domestic destinations coming from NAIA. While you can sometimes score cheap flights from seat sales, there’s always the added costs of getting to and from the airport and added fees like travel tax and terminal fees, which can feel like a pain.

Travel tax and terminal fee? Aren’t those the same thing? Nope. While they sound similar, they actually refer to different types of fees related to air travel in the country. The main difference between the travel tax and the terminal fee lies in their purposes and uses.

Let’s break it down below with the updated costs, where these fees actually go, and other things travelers should know when flying from the Philippines in 2026.

What is the travel tax?

According to the Tourism Infrastructure and Enterprise Zone Authority (TIEZA), the travel tax is a levy imposed by the Philippine government on individuals leaving the country, “irrespective of the place where the air ticket is issued and the form or place of payment.”

TIEZA collects travel taxes to help support tourism infrastructure and initiatives, education, and culture in the Philippines. This fee is typically not included in the ticket price of budget airlines, although you can get it as an add-on when booking flights.

What is the terminal fee?

The terminal fee, also known as a passenger service charge (PSC), is usually charged by airport terminals for the improvement and maintenance of the airport’s operation and its facilities. Essentially, fees collected go directly to the airport facilities. It’s usually included in the airline ticket price and is paid once per departing trip.

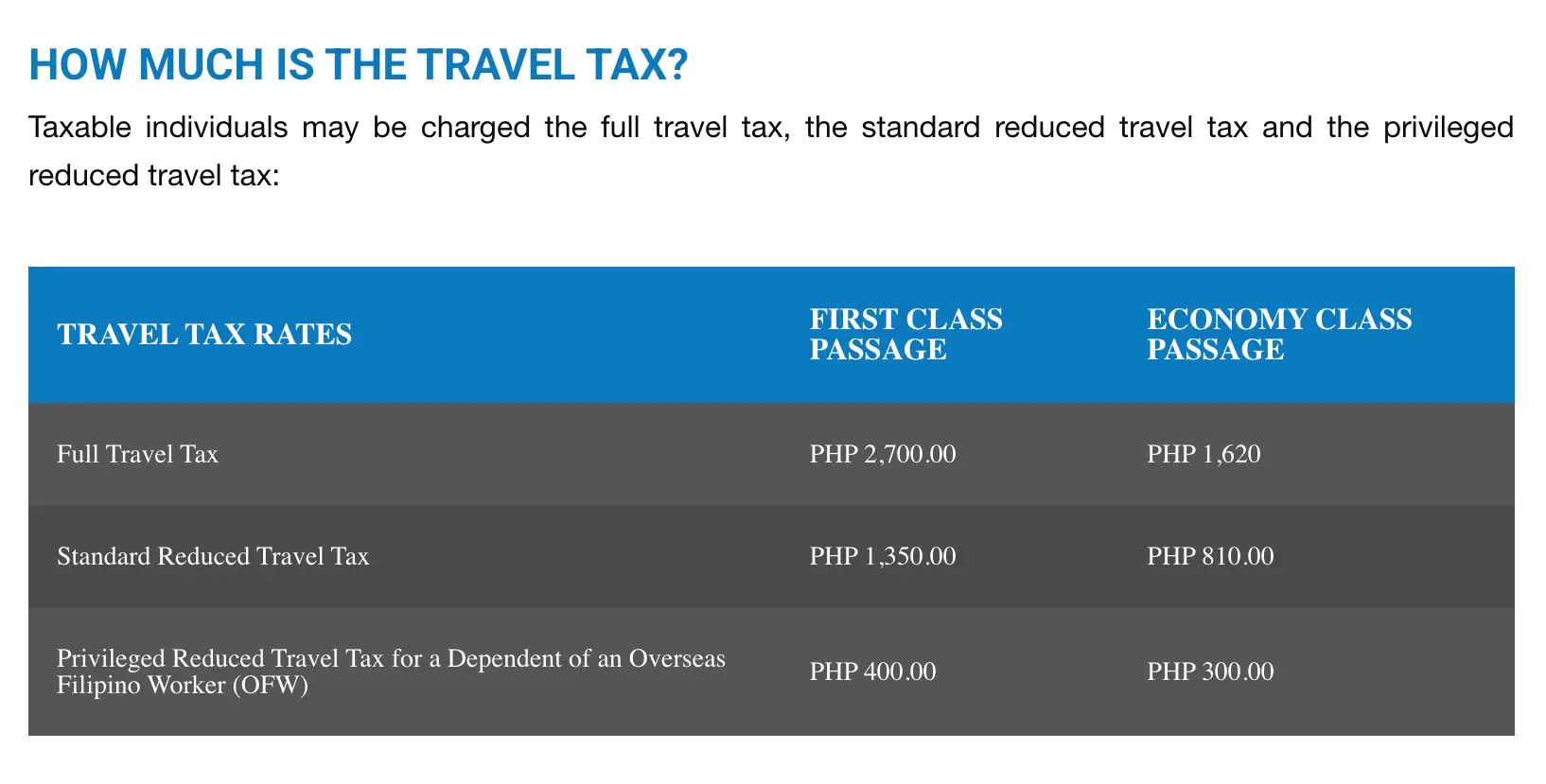

How much is the travel tax in the Philippines in 2026?

All Filipino citizens traveling internationally and non-immigrant foreign passport holders who have stayed beyond one year in the Philippines need to pay the travel tax, with some exemptions.

Full travel tax

- First class passage – P2,700

- Economy class passage – P1,620

Standard reduced travel tax

- First class passage – P1,350

- Economy class passage – P810

Privileged reduced travel tax for a dependent of an Overseas Filipino Worker

- First class passage – P400

- Economy class passage – P300

How do you know if the travel tax is already included in the ticket?

In case you don’t know if the travel tax is already included in the ticket booking, just check the fare breakdown on your airline ticket or booking confirmation. Some airlines reflect the labels ‘Philippine travel tax,’ ‘travel tax,’ or ‘PH tax–Manual’ under the taxes and fees.

In case it isn’t bundled in your ticket, you’ll need to pay it separately at the travel tax counter at the airport or through online channels. There’s an additional service fee if you pay online. To be safe, just proceed to the check-in counter first, and go back to pay the travel tax if needed.

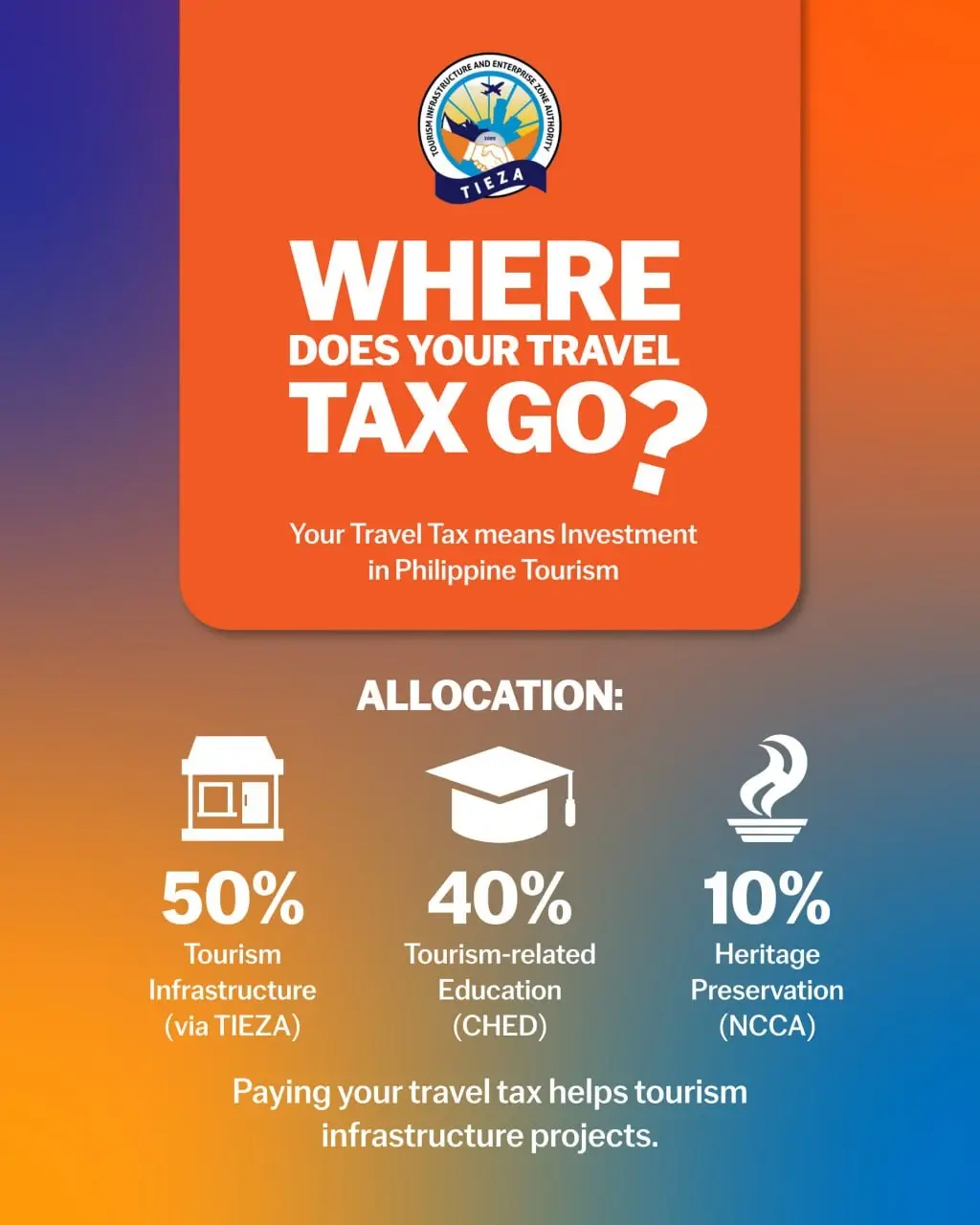

Where does your travel tax go?

According to TIEZA, the travel tax goes into nation building. Every time you travel out of the country and pay the travel tax, you’re actually “investing in Philippine tourism” and supporting infrastructure projects.

Fifty percent (50%) of the fees from travel tax collections go directly to TIEZA. Forty percent (40%) goes to the Commission on Higher Education (CHED), the government agency that manages all post-secondary programs.

Meanwhile, 10% goes to the National Commission for Culture and Arts (NCCA), which focuses on the preservation of local heritage.

In case you’re wondering, some of TIEZA’s projects include putting up tourist rest areas (TRAs) across major travel corridors, equipped with clean restrooms, tourism information centers, and souvenir shops to promote local products.

In a report recounting its 16-year legacy of transforming travel tax into tourism development, TIEZA said it “spearheaded the rehabilitation of heritage and flagship tourism assets, including the Banaue Hotel and Youth Hostel in Ifugao, Mount Data Hotel in the Cordilleras, and the Gat Andres Bonifacio Shrine and Eco-Tourism Park in Cavite.”

It also developed major tourism enterprise zones (TEZs), including flagship zones in San Vicente (Palawan), Panglao Bay Premiere (Bohol), Rizal Park (Manila), and Corregidor Island (Cavite).

How much is the terminal fee in the Philippines?

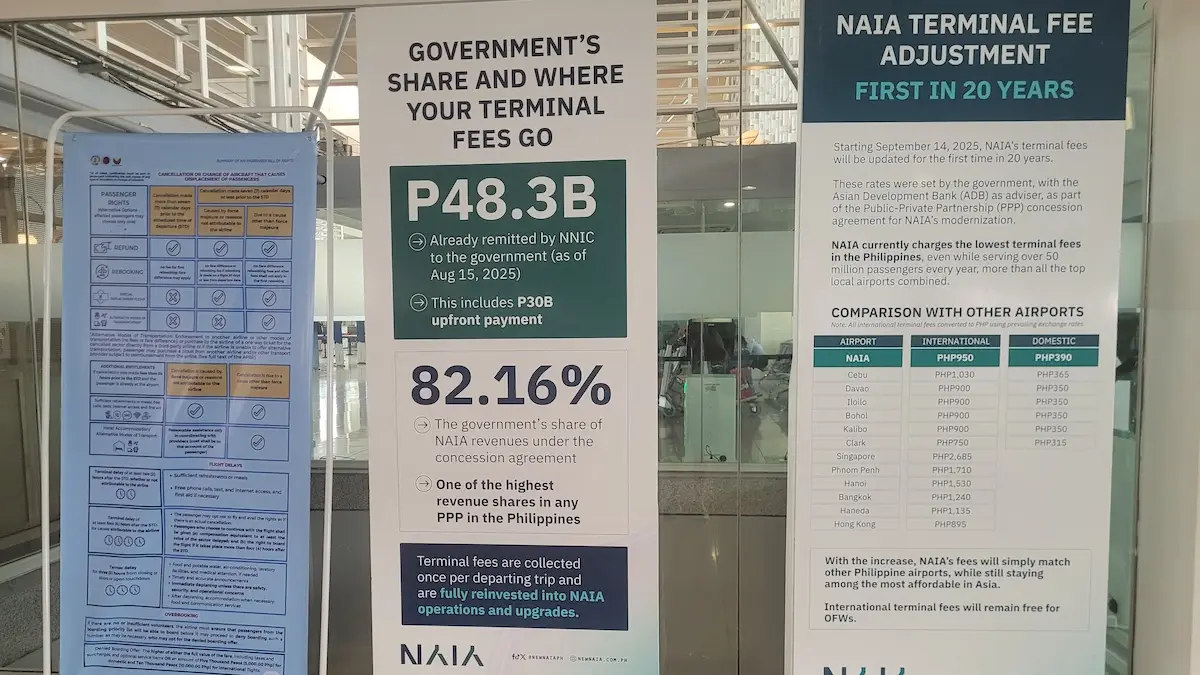

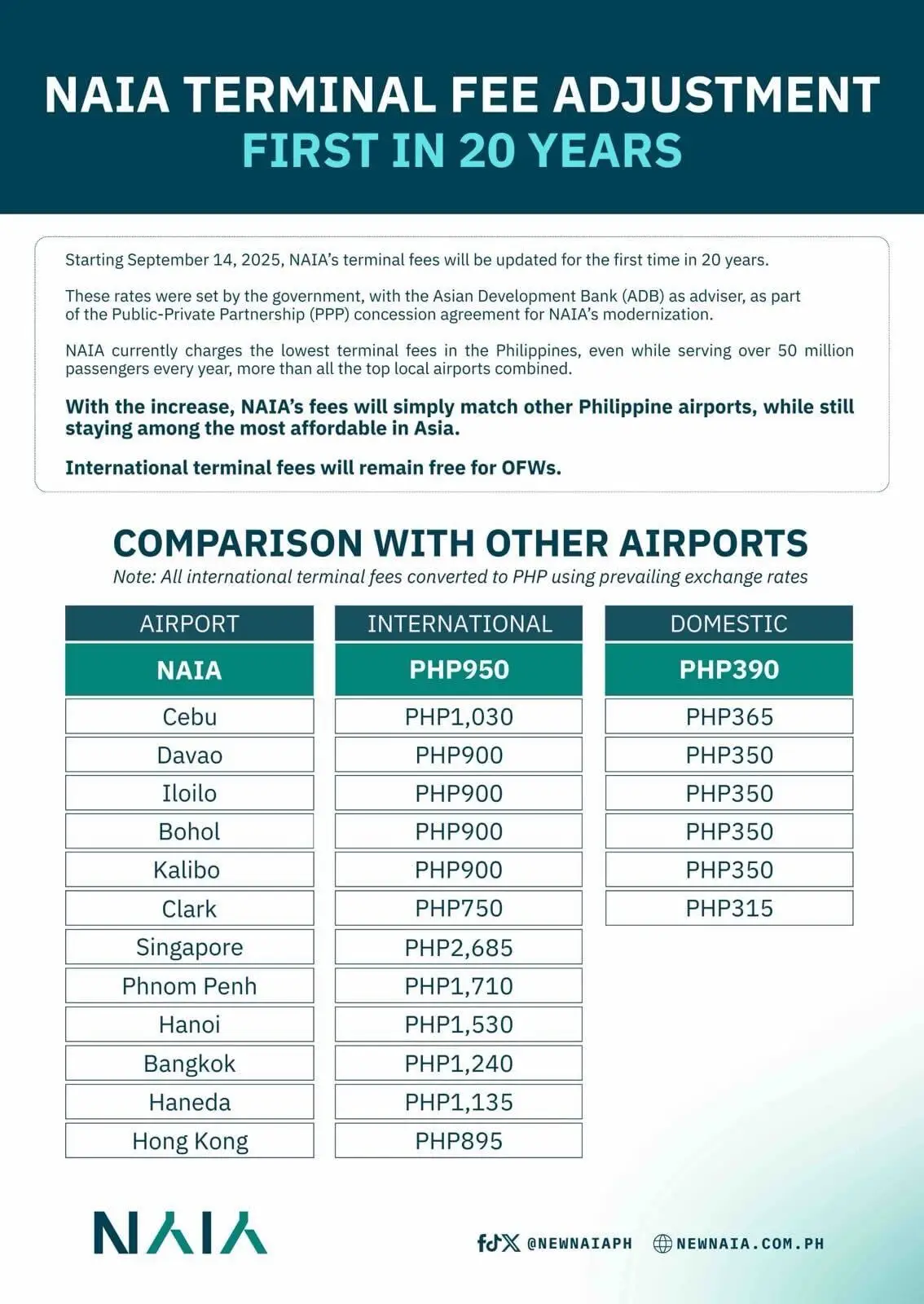

All departing passengers on both domestic and international flights (regardless of nationality) departing from certain airports are charged a terminal fee, with a few exemptions. Different agencies manage fees at different airports. The Ninoy Aquino International Airport (NAIA), which was privatized and taken over by the San Miguel-led New NAIA Infra Corp. (NNIC), increased terminal fees starting September 14, 2025.

Every departing international passenger now needs to pay P950 for terminal fees, up from P550. Domestic travelers have to shell out P390 from P200.

The private group claims this is the first time fees were adjusted in 20 years, and that the price hike was mandated by a government agreement to cover massive investments for airport upgrades.

Where does your terminal fee go?

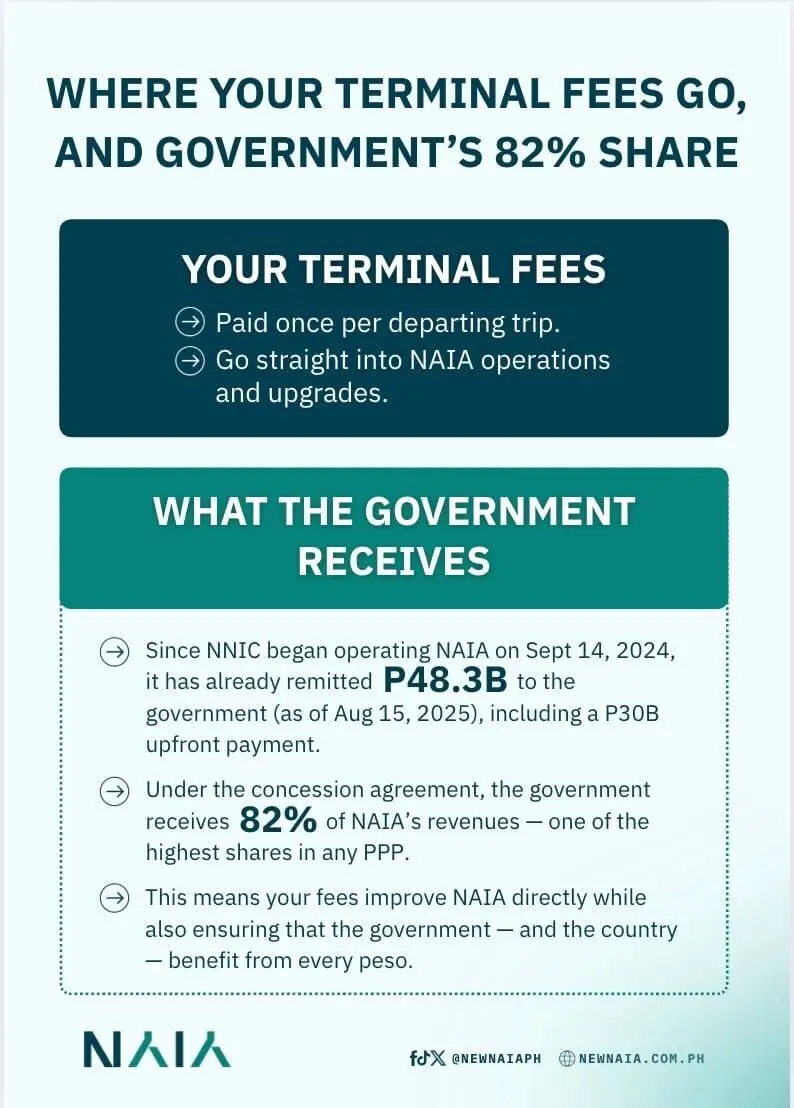

Terminal fees go towards NAIA airport operations, maintenance, and infrastructure improvements and upgrades.

According to NNIC, since it began operating NAIA on September 14, 2025, it has remitted P48.3 billion to the government. Under the concession agreement, the government receives 82% of NAIA’s revenues. This means your terminal fees are helping to improve NAIA directly while also supporting the government.

In terms of airport upgrades, some improvements we’ve noticed during recent flights include new seating, upgraded Wi-Fi, baggage handling, and biometric e-gates. Travelers can also find several large food halls, including an all-Filipino dining hall as well as a new OFW lounge in T3, among others. But as for upgrades in the government, well, that’s a different story.

We’ll try to come up with a separate guide on travel tax exemptions and how to get tax refunds soon. Stay tuned.