As we’ve reported, the House Committee on Ways and Means has approved House Bill No. 376, which proposes to replace the existing Motor Vehicle User’s Charge (MVUC) with higher Motor Vehicle Road User’s Tax (MVRUT) rates.

Just to reiterate, the approval is only on committee level and HB 376, which was filed on June 30, 2022, still has a long way to go in the legislative process. It may be prioritized given that the rationalization of MVUC rates was mentioned in the second State of the Nation Address, and higher rates mean higher revenue from collections.

OTHER STORIES YOU MIGHT HAVE MISSED:

The all-new Mitsubishi Strada is ready to take on Hilux, Ranger

New LTO chief accepts delivery of 5,000 driver’s license cards on his first day in office

So, just how much higher are we talking about? The proposed measure specifies MVRUT rates for 2023, 2024, and 2025, after which a 5% annual increase will be imposed from 2026 onwards. Rates are based on gross vehicle weight, defined as “the measured weight of a motor vehicle as specified by the manufacturer plus the maximum allowable carrying capacity in merchandise, freight, or passenger as determined by the assistant secretary of the Land Transportation Office (LTO).”

Here are HB 376’s the proposed changes to current MVUC amounts. These will apply to private and government vehicles.

Passenger cars

Passenger cars with GVW up to 1,600kg

- 2023 – P2,080

- 2024 – P2,560

- 2025 – P3,040

- 2026 onwards – 5% increase annually

Passenger cars with GVW more than 1,600kg up to 2,300kg

- 2023 – P4,680

- 2024 – P5,760

- 2025 – P6,840

- 2026 onwards – 5% increase annually

Passenger cars with GVW more than 2,300kg

- 2023 – P10,400

- 2024 – P12,800

- 2025 – P15,200

- 2026 onwards – 5% increase annually

Utility vehicles with GVW up to 4,500kg

- 2023 – P1.40 per kg of GVW

- 2024 – P2.50 per kg of GVW

- 2025 – P3.40 per kg of GVW

- 2026 onwards – 5% increase annually

Sports utility vehicles with GVW up to 4,500kg

- 2023 – P1.40 per kg of GVW

- 2024 – P2.50 per kg of GVW

- 2025 – P3.40 per kg of GVW

- 2026 onwards – 5% increase annually

Buses, trucks, trailers with GVW up to 4,500kg

- 2023 – P1.40 per kg of GVW

- 2024 – P2.50 per kg of GVW

- 2025 – P3.40 per kg of GVW

- 2026 onwards – 5% increase annually

ALSO READ:

Bill to make car registration once every three years filed in congress

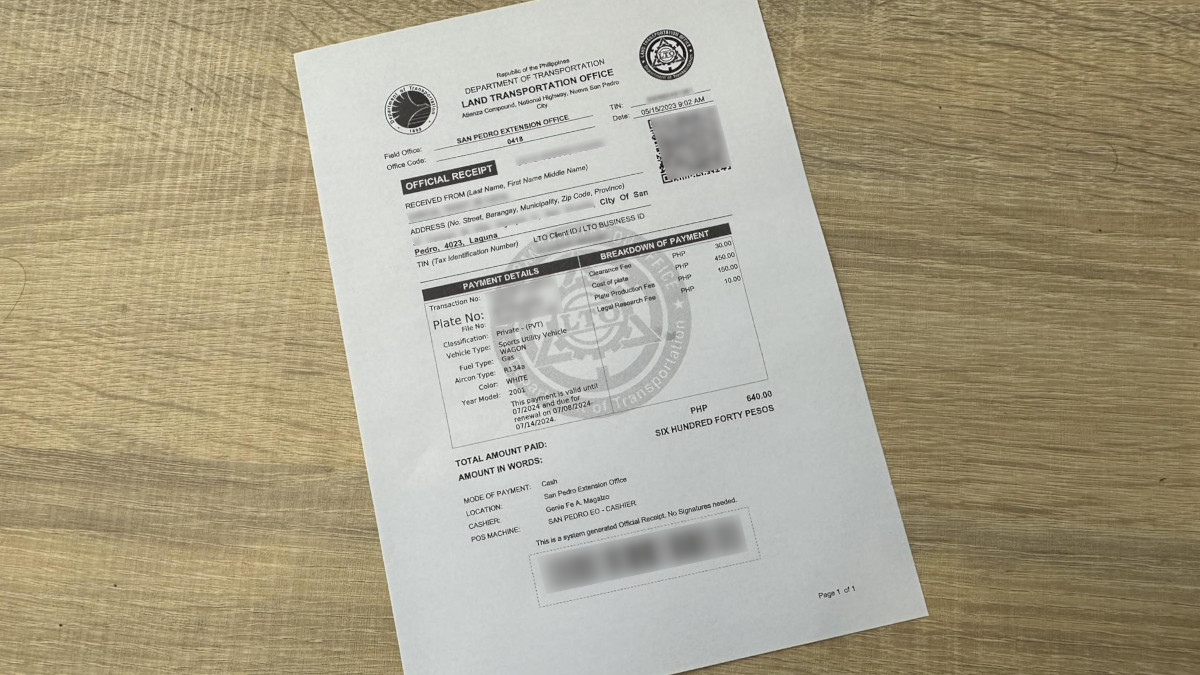

Quick guide: Here’s what you need to renew your LTO registration online

Again, the proposed measure exempts motorcycles and tricycles from paying road user’s taxes, and gives a 50% discount to vehicles for hire.

The higher fees are expected to raise some P274.45 billion over the next five years, with 45% earmarked for the PUV modernization program and 5% for road crash prevention programs. The latter includes the following:

- improvement of driver’s education programs, training centers, and driver’s license examinations

- establishment of more motor vehicle inspection centers

- improvement of road management systems

- provision of supplemental hospitalization coverage for road accident victims via PhilHealth

- provision of compensation for road accident victims who are unable to be gainfully employed due to disability

- establishment of emergency care facilities in accident-prone areas